See the original story in Japanese.

Tokyo-based Styler, the Japanese startup offering an O2O (offline to online) support service for fashion and apparel stores called Facy, announced in late July that it has partnered with Tencent Cloud, the cloud service division of Chinese tech giant Tencent.

Styler had been running the Facy app as a way to drive potential customers from online to offline fashion retailers. However, the company recognized that the expanding pandemic will significantly influence consumer purchasing behavior and decided to evolve the business into supporting Online merges with Offline (OMO) effort where retailers can seemly integrate user experience at their e-commerce site and brick-and-mortar stores.

Pandemic accelerates fashion retailers’ shift to digital operations

While fashion e-commerce represents a large proportion of the overall e-commerce market (around 20% of the total in terms of market size), it is yet difficult to completely take over all real store sales. Similar to what tech conferences and events are challenging amid the pandemic, one of the problems here is how to give consumers serendipity on online shopping.

Unlike giving users recommendations using a collaborative filtering-based engine, it may be difficult for online platforms to give users a chance meeting with the brands they have never met before while sales associates at real stores can do it.

In China in the midst of COVID-19 pandemic, we saw many sales associates at fashion stores setting up lights and tripods to to introduce and sell their products via live video streaming. For fashion brands, it would be difficult to integrate a typical live commerce app with their own customer-facing app while Tencent Cloud’s solutions apparently makes it easier.

Tencent Cloud’s solutions allow stores and customers to interact with each other while seeing each other’s faces through mobiles. The same technology has been adopted to Telelive, CyberAgent subsidiary Cyber Pal’s platform for holding fan meetings online, as well as Ignis’s dating service’s video call app.

Styler plans to introduce Tencent Cloud’s solutions to fashion brands, aiming to help them better implement the OMO into their environment. These solutions allow brands not only offer seamlessly their front-end customer experience online and offline but also to support back-end operations such as integrated inventory management of online and offline sales as well as optimized inventory operations across multiple real stores.

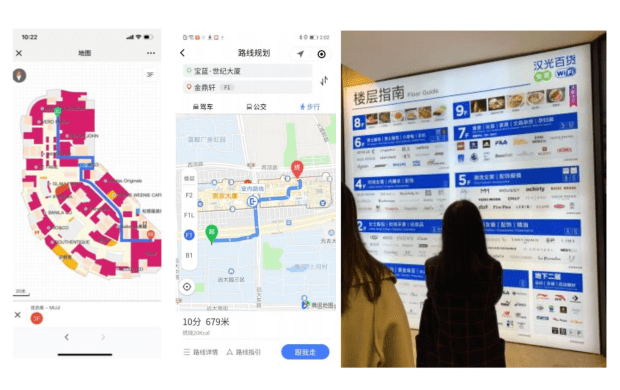

In the ever-changing fashion industry, fashion stores often come and go at shopping malls thanks to the growing prominence of direct-to-consumer(D2C) brands. Tencent Cloud’s solutions allow shopping malls to keep their store directory signage updated at all times simply by importing CAD data indicating tenant locations within the mall building. To ensure the practicality of the solution, Styler plans to conduct Proof of Concept trials with Tokyu Land Corporation (TSE:3289) which is known for operating a number of shopping malls in Tokyo.

More D2C brands focusing on online sales are expected to enter the market in the future. In view of having a lot of ups and downs, their real stores’ character don’t fit a typical long-term lease contract for shopping malls. Even in such a tough environment, keeping offering retention opportunities at real stores to brands is a big challenge for shopping malls.

Styler CEO Tsubasa Koseki explained in a recent interview with Bridge.

Leveraging Tencent Cloud’s solution, Styler is being focused on helping brands make their communication and inventory management available in a digital manner. As there is no significant player in Japan with knowledge that straddles between online and offline sales, I think Styler can take an overwhelming lead in this area.

Facy wants to be lifestyle-focused super app

In addition to offering the OMO solutions to fashion brands, Styler is working on upgrading their own flagship Facy app so that brands can easily catch up with the OMO trend. The completely newer version is expected to be out this fall.

We are currently benchmarking super apps like Southeast Asia’s Grab (turned from a ride-hailing app), China’s Meituan (previously known as a restaurant discovery/group buying site), and Columbia-born Rapii

Koseki continued:

Unlike these apps targeted at commodity consumers, Facy wants to be a lifesytle-focused OMO app serving those looking at mid-range priced products. We’re moving forward under the strategy symbolized by two keywords: New Retail and Luxury. Going forward, we’ll be also expanding into other categories like cosmetics and furniture.

In Japan, I think that tech giants like Line and Rakuten as well as other payments apps are probably trying to be a super app, but they have yet less variety in service offerings like what Grab, Meituan, and Rappi are doing. Hence, the Facy app has the potential to dominate this market in Japan if they can succeed in expanding their service offerings.